Let’s not beat around the bush:

Cash is the lifeblood of your studio. You cannot operate without it.

Cashflow, is literally the inflow, and outflow of cash from your business.

There are 4 critical boxes that you must continually check throughout the life of each project to ensure your cashflow is ample, and free flowing.

You, simply completing what you have promised to do. Fun!

You, ensuring you get paid, constantly, in a timely fashion, as stress-free and automated as possible. Boring… but critical.

You, being ever vigilant for scope creep, and adjusting your fee up, or eliminating additional scope. Hard conversation… but critical.

You, being ever vigilant for the 1 in 1,000 client that may have convinced you during initial meetings…. but needs serious and NOT fun action taken. Now.

Cant we just design already?

Yes!

After you have read, and implemented my 15 Step 2025 Ultimate Cashflow Guide!

My 15 Step Ultimate Cashflow Guide

Here we go!

As I write this I will announce to new readers, and remind long term readers, that this is all from my personal experience at ADAD over 12 years.

For that reason, there may be better practice out there - let me know! - but I am confident that:

This is the only source where a practice director, dedicated to teaching and paying it forward, live from the battlefield, including the often unspoken ‘downs’ (hard) as well as the much-more-spoken ‘ups’ (easy), lays out honestly what has worked for me, what hasn’t, why, and what I am actively doing right now, 2025.

*Limitations - This does not cross over with how to prepare your fee Proposal - there is a whole note on that here: Note 002: Fees

This is purely how to ensure you actually get your agreed cash in a smooth, timely - sometimes upfront! - But most importantly never delayed way. Including how to stop things going off the rails, and what to do, if they do.

What the Steps Are:

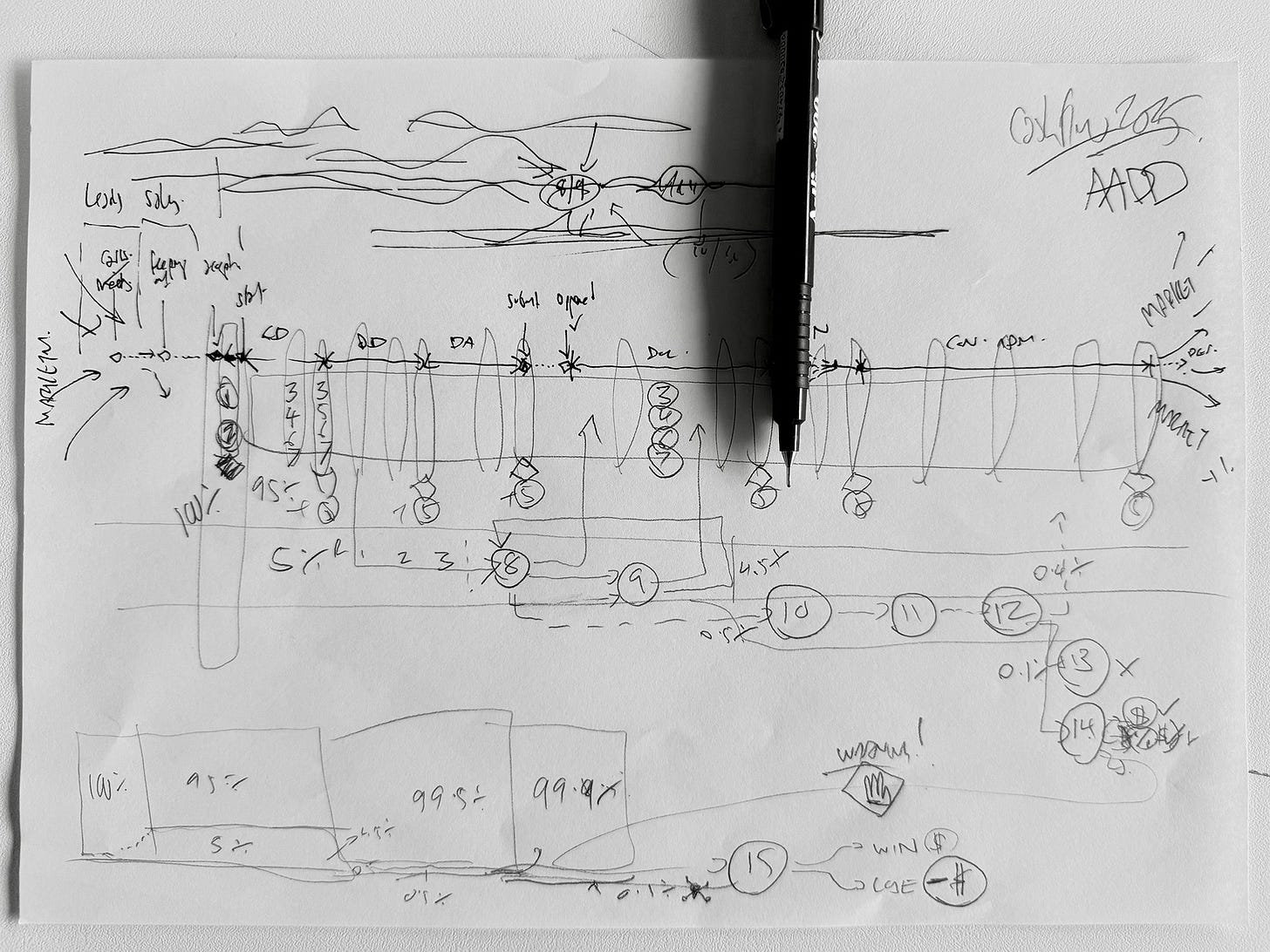

Cashflow Steps 1,2,3,4,5,6,7 are for 100% of all clients, of which 95% of your wonderful clients will begin, and remain here. Joy!

Cashflow Steps 8,9 are for the 5% of clients that are more difficult (from a cashflow perspective). The Goal here is to return and keep them to steps 1,2,3,4,5,6,7.

Cashflow Steps 10,11,12 are for the extremely difficult 0.5% of clients - jump here now if you are not sleeping!

Cashflow Steps 13,14,15 are for the rare, sociopathic 0.1% of clients - jump here now. Also, please call me directly for some emotional support if you are ever here.

I feel a moral obligation after building excitement for you to start your practice over the years to ensure you never get in this situation.

When to use the Steps:

Cashflow Steps 1, 2, Are Steps Taken After your Fee Proposal Acceptance but before you undertake any Work

Cashflow Steps 3, 4, 5, 6, 7 Are Steps Taken Throughout the Entire Duration of your Project

Cashflow Steps 8, 9 Are additional Steps Taken Throughout the Entire Duration of your Project For those challenging clients

Cashflow Steps 10, 11, 12 Are additional Steps Taken for challenging client repeat offenders, the project is paused here.

Cashflow Step 13 Is termination -

the wrong way.Cashflow Step 14 Is Debt Collection - the right way

Cashflow Step 15 Is *Legal Action - (***An action I have not personally taken***) - to be avoided.

Let’s roll.

1. Mobilisation Fee

This is a stand alone fee to Mobilise the project and is in addition to your Concept Design Phase Fee.

You can set this at whatever is suitable for your practice. Itemise it in your contract.

Pros:

This allows you to be cashflow positive from the very beginning of the project.

This stops tyre kickers in their tracks.

This stops very pushy excited clients from demanding immediate dropping everything to work.

You get a great gauge of where this client is likely to sit amongst these cashflow actions throughout the duration of the project, based on speed of paying up front

Cons:

Not all clients will agree.

Some will ask it to be rephrased as a deposit on concept design. Itemising it however allows you to add back on top of your concept design fee if possible

2. Deposit

This is an upfront % (note Act limitations on deposit maximums) of your 1st stage, ie, deposit is $x% concept design. The Holy Grail (of cashflow) is for your 1st invoice to be your Mobilisation fee and Concept Design Up Front Deposit to be issued as 1, pre work payment to you:

Pros:

This allows you to be even more cashflow positive from the very beginning of the project.

As with Mobilisation: This stops tyre kickers in their tracks.

You get a great gauge of where this client is likely to sit amongst these cashflow actions throughout the duration of the project, based on speed of paying up front

If a potential client refuses a mobilisation, or deposit invoice - gold mine! - a red flag has been raised before beginning and you can respectfully turn down the project.

Cons:

Not all clients will agree (on both).

If agreed and paid, you of course need to be able to act and resource their project immediately! (really a pro disguised as a con)

3. Invoice on the 1st of the month, every month, no matter what

This Golden Rule is as critical now, as the day I learnt it. Long term readers will remember that this was 1 of 3 original top 3 tips for those that have just launched their practice way back in Note 000: Kick Off

Pros:

The major no. 1 cashflow key - your timely invoicing! This keeps cash flowing

This allows you the mental space to push slower paying clients to the end of the line, when you are doing everything yourself early days keeping them in check

This, by forcing you to invoice only a tiny amount for any clint you have not focused too much on that month, keeps you in check to deliver thier programme, which magically - delivers your cashflow!

Cons:

None. This is a golden cashflow rule.

4. Payment Terms Progress Invoices

Power Up: There is a gap between you sending out your invoice, and whan it is due. I started with industry standard 30 day payment terms not recommended.

We currently vary between 14 day and even 7 day payment terms. remember, cashflow, is the gap between you dong the work, and getting the cash.

Unblock that pipe. Get it flowing!

Remember you are not billing more frequently, we bill monthly for instance, you are simply shortening the gap between sending your invoice and receiving the actual cash.

Pros:

There is magic in tightening the payment terms. Shorten to as short as you feel comfortable, and also the dollar amounts - this is a business decision, and clients need to agree. Smaller = Better.

Cons:

None. This is a golden cashflow rule.

5. Payment Terms Milestone Invoices

Additional Cash Power Up: Same day / date of Issue terms for Milestone Invoices.

Feel out which clients this needs to actually be enforced for, it may be overkill, and like most additional points, not neccessary at all for the majority of great, clients, and ongoing relationships.

Pros:

Additional Cash injections for small chunks, of when say, the final 5% of a stage is completed very early in the month.

The inverse to that pro - it stops slow, ‘completion-dragging-clients’ (ie, many many small requests - buying time for themselves- to sign of on a ‘complete’ stage)- ie, you were gunning for 100%, months end comes up, adn you can still invoice 95% for these clients (rare).

Cons:

Could be perceived as annoying - we do not implement for our great, quick paying, grateful clients if too close in time to a previous invoice, but if not go for it. Use judgement.

6. Automated Payment Reminders

OMG..

When I (early days) finally committed to an accounting software, (vs super early days sole trader, excel, trying to wrap everything up once a year with my accountant ) My mind was blown:

The automating of reminders is the single most valuable thing, pain point removal, I have invested in!

Pros:

Absolute godsend. You can mentally ‘switch off’ from second guessing yourself (as projects are never fully complete, early days I would feel ‘guilty’ emailing reminders), by having a totally seperate, impersonal, annoying :) reminder-bot doing this for you.

Bonus Power up (Shout out to my mate Cam of CAA in Mudgee for this one!) - A day before due friendly reminder (automated). This works wonders!

Cons:

None. This is a golden cashflow automation

*edit - In the rare instance you have an EXCELLENT client that pays immediately ,through a method your software does not pick up automatically, ensure you have these payments manually entered as quickly - nothing worse than a reminder when you have paid quickly !

7. Interest on Late Payment

Within your contract, there should be a clause / terms on interest payable. (We have it, but have never enforced).

Pros:

Financial penalty for late payment in theory should quicken payment cycle (I have never personally enforced)

Cons:

None that I can foresee (I have never personally enforced)

That concludes the day to day, ultimate cashflow guide for 100% of all your lovely clients, and in reality, the best 95% of all your clients who will never stray from here!

Now we move into the more challenging territory of the more difficult 5% of clients that surface throughout the process.

Fear not, we are in business here, and you guessed it - that means it’s likely our fault, not theirs. Stay humble. But stay vigilant.

8. Non - Automated Additional Reminders

Once your automated reminders have run their course, It is time to get on the phone, email, text, or all 3 to follow up. There is a 50/50 chance of it actually being missed (but that means missing all your automated reminders - so keep a close cashflow watch for repeat offenders), or, the one you really need to act on - a client is disgruntled (Step 9).

Pros:

As with most things, direct, personal action, over an automation, has higher chance of action.

It is a friendly get out of jail free card if they have actually missed the reminders, or, had their own cashflow challenges (be vigilant after this).

Cons:

None really - yes it takes a lot of mental space, but if the difference is this or not getting paid it is worth it. We just do not want to be doing this across every invoice, every month - which is why Step 6 is so golden.

9. Listen, Humility, Benefit of the Doubt

This is important, you are in business, which means the architecture business, but mostly, as with all businesses - you are in the client happiness business first.

This is more operational than cash flow but I will give a brief synopsis here:

Set a meeting. Hear their gripes. Do almost anything to bring them back around. Do give the benefit of the doubt. Then gently remind why it is so important to be paid as a small studio, and if there was something you missed, quickly do it, and resend.

Yes - of course you should be servicing your clients impeccably the whole way through! But remember, this isn’t the 95% of clients that you do that for and they pay on time and happily. This is the rare 5% where you are delivering your side of the deal, but they are not.

Pros:

This is an Olive Branch Opportunity to go above and beyond for a difficult client, and this tends to smooth, solve and take care of 90% (ie, 4.5% of the 5%) of clients that show up here. Definitely worth it.

For about half this group, the behaviour wont repeat, and you will not need to visit steps 8 and 9 again. Hooray!

Cons:

They may only be beginning to start the process of hoisting up this red flag as the 1st of many, and you very much want to discern that before it escalates.

That concludes our difficult 5% cohort. If your gut feel is that you indeed simply missed something, through miscommunication, resume to the healthy steps 3,4,5,6 cadence :)

However, If your gut feel is that this the beginning of a red-flag-repeat-offender parade - resume to the healthy steps 3,4,5,6 cadence - with cautious optimism.

If they repeat and you find yourself here again at steps 8-9 - and your gut feel is confirmed, escalate to the final group.

For the extremely difficult 0.5%.

10. Stop Work

Stop work. Gently remind of the Invoice, the pattern that is occurring, and that you need to pause their project.

They may be very pushy, and insist on a meeting. (remember this past the step 9 above and beyond olive branch meeting you have already had, and which returns 90% of the small disgruntled / difficult group back to happiness).

So that answer is no.

Phone call only, at a time convenient to you. It’s about salvaging your mental space, so for me, I will typically only schedule these calls if necessary at 5:30pm.

Take solace, this is a rare breed of client, but it happens, and the overarching take away is: They have shown a pattern, continual late payment and pushiness, that they are responsible for breaking.

Pros:

Mental clarity and the reclaiming of your precious time to triple down on your 99.5% of great clients!

Cons:

Ensure you are not kicking the can down the road - if they need escalation to steps 13 and beyond, keep this guide at ready reference. It is hard to tell.

11. Extended Terms

Hear out the phone conversation, things happen, life happens, they may simply need extended terms. It probably suits you to have them take their time to pay, to clear the decks of communication and focus on your excellent 99.5% of clients!

This is very important to do - for your mental health - for your clients - and for your cashflow: triple down on keeping the majority of your lovely clients happy!

From a cashflow perspective, at this point, I remove expecting this to be paid within any particular month from projections, so you can move forward other leads that you may not have been scheduling in time blocked for their project.

Remember, you can only control your actions and inputs - ie, positively moving forward other relationships - not the actions of others.

Pros:

Time clarity to triple down on your 99.5% of great clients + Follow up fresh leads and proposals

Cons:

Nil - you are removing the negatives by clearing your schedule.

12. Cadence for Reminders, prior to Escalating

Mentally you are clearing space by ‘removing’ this project, but as your automatic reminders have long since stopped, just manually remind yourself to send reminders, once a month, as it is important you have your track record for the following steps.

Pros:

You may actually get paid very very late!

You are building the necessary communication chain for the following steps

Cons:

You’ll get briefly angry every time you enter their email! haha :) breathe… let it pass….

That concludes our very difficult 0.5% individual.

If you get paid, you really have to weigh up other business and project factors here, is the relationship worth it? This will very likely repeat for the duration.

The answer, is almost aways no. The headaches will get worse, and the project will suffer.

Outcome A) Payment and Finalisation of Relationship (Step 13)

It is hardest if it is one of your more incredible designs - its likely not - great clients and projects go hand in hand - but if so, and especially if you are near the end of the project, you have to decide for yourself!

Again, the answer, is almost aways no. It is rare for a personality to completely shift at the tail end of a project, where it was not an issue before.

Outcome B) Payment, but *repeating the cycle - judge as above

This is not to be confused with the general stress and challenging, but exciting difficulty of delivering architecture! This is for a consistent, repeat, non-payer, that is negatively impacting the rest of your practice and projects!

Outcome C) Still no Payment. Progress to final steps..

For the very rare, but real redacted-description-of-description-of-person-but-you-will-know-if-you-ever-come-across-one …0.1%.

13. Termination

Yes, you wish you never met this chameleon. They have likely had you second guess your own processes, feel large guilt, double down on providing ‘extras after extras’ to bring them back around…

But the Truth has revealed itself.

Terminate the Agreement.

Ahh, relief!

This should be very rare, - but it does happen. For context, I have only had to do this once in 12 + years.

Pros:

Song birds sing. The clouds part. Stress vanishes - relief!

Cons:

You have been bullied into not being paid for your hard earned, legitimate work; stress, knock on effects on other projects, team morale, etc.

That is why I have only done this once, and it was 11 years ago.

Last year however, I had been pushed too far. The damage extended beyond myself, into employment hours for team members that rely on paying clients.

Impacting me I can handle. Impacting team members?

Now, we have a problem..

14. Debt Collection

This note was originally going to purely outline step by step for this situation - engaging a debt collector - but, frankly it seemed too negative :)

Its really important to know your rights and steps, (the point of these notes - saving you heartache!) but for any new readers, I wanted to cache this within what it is -an infinitesimally small percentage of your engaged clients. 0.1%

Literally - this will not happen 99.9% of the time.

Following on from Step 13, termination would have felt like gold! (It does), but this is a matter of principle.

I will go through the actual steps, before pros and cons:

Background: for this Invoice and ‘*Client’ there had been more than 3 months of total ghosting, 7 reminders, on and on and on, I had actually given up by this point. As in, there was no way this was proceeding no matter what, even if payment was made.

Debt Collection Step by Step

Ask around - where do you find these people? In hindsight, I could have asked other architects - but I asked my accountants - as I assumed (rightly) that they need to deal with this across multiple businesses

They should know, a pitbull :) And a pitbull is who you want on your team.

There will be terms of engagement - the pro I engaged was 15% of recovered amount. There may be a whole host of alternative options. Their advice was, he takes a cut - but is an expert at this and this alone.

Give your pitbull an introductory email, full, honest, transparent backgroud information

Unlike some other professional relationships, your pitbull will smell blood and act immediately :)

Forward on whatever is requested, summary of email interactions, ignorances, reminders, the invoice, your contrac.

Sit Back, let him at it, and await your next contact. With peace of mind, that this is probably the most hassle free, most cashflow valuable consultant you have ever retained

They begin negotiating on your behalf, back and forth clarifying, (I have heard this can go quickly and smoothly - my experience was very drawn out, but this was a very ‘particular’ person.

You will likely come to a point of back and forth, like an auction, of somewhere between your full amount, and less than that, possibly far less.

Outcome A) You get paid in Full, purely with the threat of external debt collection. Best Result!

I have heard of this - but alas this was not my experience

Outcome B) You get paid whatever the end point of back and forth negotiations where between your Pitbull and the Client.

This was my experience. leave it in the hands of the expert. In this case, the character in question, upon digging, has a long history of non-payments, for sums far far greater than what was in question - and of taking it to court and fighting it. No good!

Outcome C) You do decide to escalate to court… (Step 15)

I will cover below - *note - I have not experienced this - I asked my pitbull to give me a clear understanding, purely for this reason - to educate other young practitioners (you guys!) of what is possible or probable

Pros:

A warm, fuzzy feeling, that for a no-win-no-charge, you are engaging an absolute expert, to persistently act on your behalf until an outcome has been met

A great third party to actually see the holes in your current contracts, for you to reflect on, systems to tighten, etc.

Cons:

NIL. Paying out a % of nothing, is far better than 100% of something!

If you went to this step too early, it will obviously strain / end your project - remember - this is 0.1%

15. Legal Action

*Following from Step 14, I have not ever taken legal action - do not intend to - and this is of course not legal advice!

This was my Pitbull’s explanation of the following steps is settlement, ie the amount, was not something I would accept.

At the point prior to accepting a settlement (lesser payment), I realised how furious I was with the whole situation, tempers flared, the damage of not being paid had already happened, and I grandly declarred:

“This is infuriating me. That invoice already contained signiciant discounts. I’ts 6 months overdue. I’m taking

redacted-personto court on principal!”

That was the first time I heard my piutbull laugh :)

“Andrew, let me give you the best advice you will ever get. Never, ever go to court (with an invoice of this amount owing up against the type of character this was) on principle!”

And that, was a wise cashflow move.

*Steps that would need to happen to proceed to court *

***I did not and have not personally done this***

Your Debt Collector will request a legal quote, or I am sure you could go this route yourself. Your quote will include

Drafting and Filing a Statement of Claim

Filing Fee

Serving the Defendant

Other Applications

The important bottom line from a cashflow perspective, you will be up for around $2,000 up front - wether successful or not.

• If there is no defence, you should be paid in 28 days. I was advised in this instance that was 100% unlikely, as this person was 100% going to defend.

Meaning:

• There would likely need to be another $4,000-$6,000 up front now, paid in trust, to a lawyer to defend in court at a future date

Pros:

Unsure... I imagine if the amount owed was significant where $6,000 - $8,000 was only a small fraction, it would be worth pursuing? (see conclusion for why this should never be the case!)

Cons:

Dragging on

No guarantee of success

definite, significant up front costs - wether you eventually recoup your invoice of not

2025 Cashflow Conclusion

It is essential that your cash flows freely, as stress free as possible through your studio, so that the wonderful life of creation, design, and vision delivery out there in reality can be possible.

No cash, No Design.

So for 100% of your clients:

- Get mobilising + a small deposit to kick off each project cash positive with full capacity to deliver!

- Invoice 1st of the month, every month, no matter what - with a short payment terms as possible!

- Set auto reminders, including ‘due tomorrow reminder’ to encase your precious brain space where it should be - in joy of the project as you continue to design and deliver! (Not on chasing money)

- Include additional 100% milestone invoices to keep pedal to the metal!

That will keep 95% of your wonderful clients happy, your team and accountant happy, and keep the studio wheels greased to keep on focusing on what you love to do!

And for those difficult 5% clients:

- Meet sooner rather than later, to go above and beyond in service, to either zoom them back to the super happy majority, or, confirm any suprise red flags early

That will raise your 95% to a staggering 99.9% happiness factor!

And for those very difficult 1 in 1000 situations:

- Get yourself a pitbull as soon as possible, enjoy the mental clarity, and avoid court :)

See you soon, lets make 2025 a cash positive year, and in the words of David Lynch in honour of his recent passing:

“Keep your eye on the donut, not on the hole”

David Lynch

Note 030 done and dusted!

Please give me any feedback whatsoever on this experiment, I would love to hear from you - after all, this is for you :)

I’ve shifted from ‘short and regular,’ to comprehensive and less regular - let me know your preference - including next topic!

PS - if you have a friend, colleague, or archi-buddy that you think would benefit from Andrew’s Notes, please feel free to send this to them or share with the button below: - lets grow this tribe :)

Excellent Andrew! I did enjoy this less regular but more in depth note.

Question - 1st of each month - if a weekend or public holiday, do you move to 2nd or 3rd? Or it’s 1st of month rain hail or shine?

Recommendation - debt collection through security of payment legislation. Up front fee rather small, if adjudicator finds in your favour (highly likely) then fee is assigned to the client. 100% success rate recovering entirety of unpaid invoices thus far. Alas I’ve had to use this 4 times in 5 years of business (but I tend to skip step 9 😬)